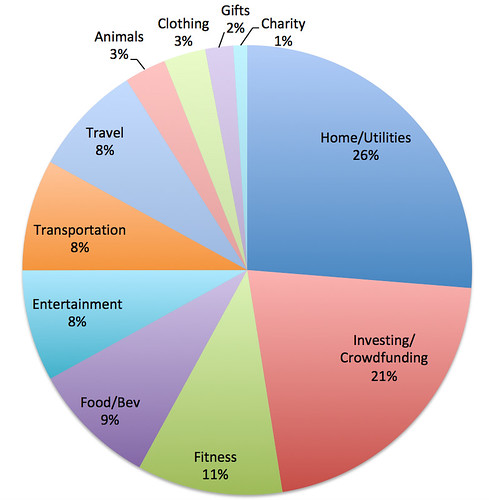

In the past, I’ve only posted spending summaries at the end of each year. I think it would be a better way to stay accountable on “saving more” throughout the year by looking at it quarter by quarter and making adjustments as I go. Here’s what the first quarter of the year looked like as a percentage of overall spending:

Home/Utilities (26%) - I’ve lumped mortgage, utilities and home improvement into one category. Since interest is greater on the loans than what a savings account would earn, I’m committing to paying more on them this year. My tenant moved out in mid-February, so there were some additional expenses related to getting the rental property up and on the market again.

Investing/Crowdfunding (21%) - This category represents post-tax savings, investing and in some cases, crowdfunding. In the first quarter, I supported some friends who are opening up a wine bar in Brooklyn. They are crowdfunding to raise funds that they’ll need to get their business off the ground. There’s obviously a risk when it comes to investing and crowdfunding - it all depends on how the market’s doing, and a loan I’d made awhile back to someone starting a business ended up flopping. So this riskier bucket of money will likely shift to the first category.

Health/Fitness (11%) - As mentioned the other day, we’re paying a little more attention to our health. This will go down when we’ve weaned ourselves from our amazing personal trainer.

Food/Bev (9%) - Most of this was due to eating out. We found a local sushi spot we really like and have tried to make it our regular spot, at least for celebrating an occasion. There were a lot of different occasions in the first quarter (ie. new job, promotions). We are slowly shifting back to eating in when we can. Groceries are a little less than a quarter of this category, and I don’t really foresee it changing too much. We do most of our grocery shopping at Costco and periodic farm boxes, both which yield large quantities of produce that must be eaten or processed quickly. We replaced our broken chest freezer late last year and vacuum sealer early this year, so now we’re back to meal prepping a ton to freeze and eat later.

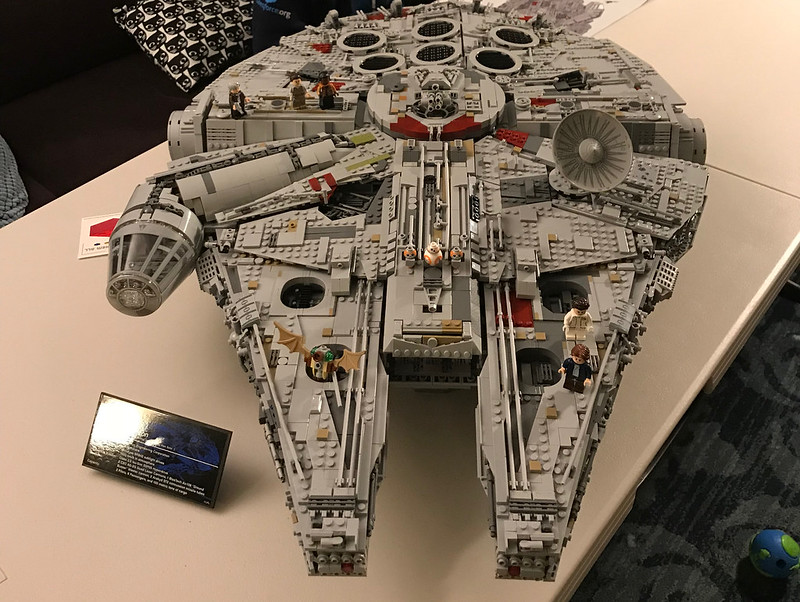

Entertainment (8%) - The bulk of this expense can be summed up in two big purchases we made in the first quarter: Legos and Broadway musicals. I would expect this to go down in subsequent quarters since we paid upfront.

Put this together in about a week - could’ve gone faster if I didn’t sleep!

Transportation (8%) - In February, someone rear-ended us and did way more damage on the car than we originally thought. It took nearly a month to get our car back, and we had to pay our deductible. Hopefully insurance sorts itself out, and we’ll get reimbursed for that since we weren’t at-fault. We’re also making monthly car loan payments. The interest rate is 0.99%, so we’re just paying that on a monthly basis for the duration of the loan. We had a parking spot downtown when Ryan could bring the dog to work, but by mid-March, we had switched over to commuting in by bus since Fresca isn’t allowed at Ryan’s new office.

Travel (8%) - Disneyland is included in this category, but the bulk of my spending was stocking up on gift cards for future travel use (examples - Airbnb, Hotels.com, Uber). Since I know that we will be traveling in the future, whenever I see gift cards on sale (usually for 3% or more off), I’ll buy some and pay for the cost upfront. The site I use is: Raise.com. If you use my referral link, we will both get $5 off when you make a purchase within 30 days of signing up.

We’ve been making the most of our annual pass since New Year’s Eve.

In terms of the INCOME side of things, aside from our normal paychecks, we had a few bursts of extra cash in the first quarter. In January and in March, Ryan got bonuses. As soon as I could, I filed my taxes and got my return. March had an extra Friday, so I had an extra pay period - WOOOO! These increases were offset by less rental income in the first quarter.

I can already see spending in many areas trending downward. Should be interesting to see where Q2 lands!